Posts

The organization delivers your percentage as the both a, wire transfer, or ACH bank transfer. We’ve got and left track of people will set you back a part of the brand new best mobile fee applications. First relaxed deals only need one to has a simple-but-active software, however if you are searching for more abilities, the newest paid-to have alternatives might possibly be worth a look. We’ve seemed the importance for money facet of any included here.

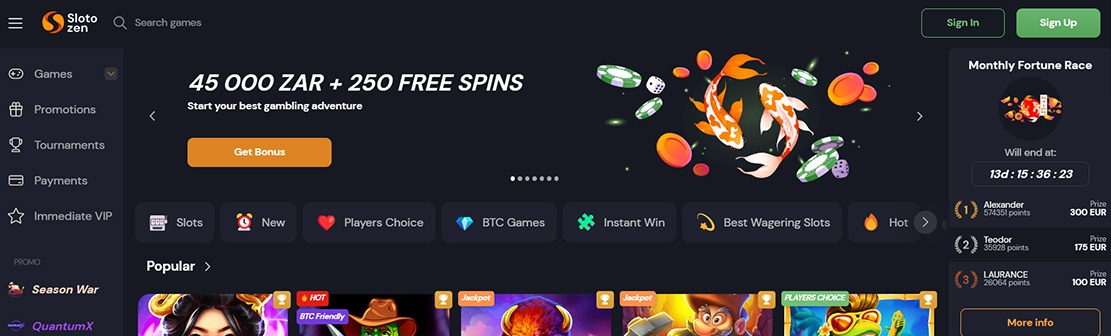

Shell out The Expenses which have Crypto

That’s why you need to disable record study play with when you go to the new options in your smartphone and you will shutting off the back ground analysis utilize for each and every app. Whether or not joining automatic fee or paperless asking acquired’t save tons of money, it’s nevertheless you to useful tactic to lower your own mobile expenses. So, make sure to pick paperless billing otherwise auto-shell out today. Gamblers who’ve sort through the newest sections looked in this article will get considering themselves a great base-up on its go gambling thru cellular telephone statement.

Finest playing cards to invest costs and secure rewards

Having Hiatus, all of your economic obligations are in you to put, in order to more readily control your using and even generate specific change to put you to your road on the financial achievement. Asking when the At the&T often match an opponent’s rate can seem to be risky. Yet not, support service agencies is actually advised to keep customers who’re searching someplace else for a reduced price. They are a lot more prepared to help for individuals who stand, even if they wear’t satisfy the competition’s rate. Not one folks want to lay on the telephone all day long, otherwise 30 minutes at this. However, possibly you to’s all it takes to locate anywhere near this much far more of the From the&T characteristics.

- After you deduct the money straight back from the total count paid ($103 – $step 1.55), you’ve in fact invested $101.forty-five to your a good $a hundred.00 domestic bill.

- Financial deposit profile, for example examining and deals, can be susceptible to approval.

- Of a lot Uk gambling enterprises deal with PayPal while the each other a deposit and you may a good withdrawal.

As with any almost every other buy, you are able to earn rewards on the monthly mobile phone costs that with a good advantages charge card to cover their bill. If you know which card to utilize, you can purchase around 5% straight back on your mobile expenses monthly, and the ones benefits adds up through the years. Depending on the sportsbook which you choice having and the mobile phone expenses payment service you employ, you will constantly end up being betting through an encrypted and you will really-protected system.

Opened the fresh app and you can tap Put a cost approach to create another credit for your requirements, following proceed with the tips. If you have several notes, faucet Build standard lower than any of them to set usually the one that will getting first-in the newest queue and if you might be spending to own anything. Which have Chase to possess Organization you’ll discovered advice away from a small grouping of organization professionals who specialize in assisting improve income, taking credit options, and you will controlling payroll. Select organization checking, business handmade cards, vendor services or visit the company money cardiovascular system.

Bundling the cost of cellphone provider may actually save you a little a bit eventually, specifically if you features a large members of the family. There are an array of money-preserving applications that may help you save vogueplay.com site money across all of their costs, not just your own cellular phone bill. Find one that’s right for you and have already been preserving, our favorite one is Rocket Money. Saving money starts with considering exactly what characteristics you’re also enrolled in and you may exactly what cost your’re also currently using.

Since 30% of your FICO credit history hinges on it ratio, it’s best to keep your account balances as low as you are able to. Electronic money provide many benefits, particularly if you’re a savvy and you can responsible charge card representative. For many who’d desire to choose credit cards to invest the rent, home loan, and other expenses, getting strategic regarding the and that card you utilize. A big next costs, for example, was a convenient costs in order to earn a premier-value signal-upwards added bonus. Sure, you can utilize a charge card to pay expenses, however, you’ll find dangers you must know in the.

Competition with other companies is strong, so they might just agree! A great QR password often discover that the cashier can be techniques since the a card, and you may examine. For many who don’t gain access to the new My Verizon application (or if you merely dislike entering something on your own smaller cellular telephone screen with your wider fingers, at all like me) you need to use Verizon’s website to spend your bill.

Preserving more money per month can be done, along with this type of 14 indicates, you’lso are bound to place a few more bucks into your handbag. There are many experience you can discover when you’re doing work for At the&T, for example customer care, sale, and technology service. If this’s work you works if you are going to university or simply just something you purchase to get those individuals offers, doing work for In the&T could be more satisfying than simply do you think. Among the toughest actions you can take these days try continue track of in which your finances is certian.

- Choose one that’s true to you personally and have started protecting, our favorite a person is Rocket Money.

- To allow which for your kids, establish a family group Sharing Group via Fruit otherwise Family members Hook up inside the Bing.

- In addition, it offers an advanced away from shelter that with multiple-action authentication processes to safeguard the purchases.

- They are able to give you advice on what is the next finest step to experience the money you owe and now have a control on the cash.

- If you’d like to explore research while you are traveling past European countries, the cost may differ dramatically depending on your own merchant.

- On the web costs shell out features, usually given by banks, allow you to agenda payments straight from your account.

However, that isn’t the only real reason to expend the costs with credit cards. Naturally, the brand new rewards earned on the month-to-month mobile phone commonly going to be sufficient to completely offset the cost of a yearly percentage on the a card. You should know using a credit that may in addition to secure rewards for the almost every other buy classes your apparently purchase within the. You’ll not score “points steeped” by simply using the month-to-month portable statement that have a charge card. But it’s still important to use the best cards to cover you to definitely month-to-month debts.

The only metropolitan areas the fresh MST feature obtained’t job is anyplace you should insert the credit, such an automatic teller machine server, otherwise a gasoline pump. To get going with Fruit Spend, open the newest Wallet software that comes pre-mounted on your new iphone 4 and you can add the cards that you want to utilize. You will also need to are the defense password, on the right back of each and every cards. The brand new Purse app usually get hold of your lender to verify the new card, and after that you’re also installed and operating. Wearable maker Fitbit has experienced its very own Fitbit Pay program as the 2017—and can continue to do so no less than up until Yahoo performs away what it will also perform in it. Like with Apple Pay and you can Google Shell out, you can utilize Samsung Shell out on the Universe cellular telephone otherwise view everywhere the thing is that the new contactless percentage signal, through NFC.

The newest selling range from extra cellular investigation, solution rewards, or a share of your payment. Pose a question to your network supplier if they offer any incentives to have enrolling inside automatic costs. But possibly the conclusion the brand new month happens reduced than questioned as well as the equilibrium on your own checking account may not be sufficient to pay for your expenses. If date is actually of your essence, it may be you are able to to pay a costs from your savings account—but there are some grounds it isn’t demanded. Having an android unit, very first, go the fresh “Settings”, next “Connections” then turn on “NFC and you can contactless repayments”. See “Anonymous cards”, “Next”, and you may “Accept” the brand new Terms of use.